This calculator will provide good results but you may want to also talk to your loan provider to get a calculation from them. The most significant factor affecting your monthly mortgage payment is the interest rate.

(payment = principal + interest) Monthly Extra the extra amount you plan to add to your monthly payments on this loan to be applied to principal You can likely look at your last statement to find the amounts applied to principal and interest and add these 2 numbers together. Current Monthly Loan Payment the amount currently to be paid on this loan on a monthly basis toward principal and interest only. Make Extra Payments Calculate how much your loan term and interest will change by applying extra money to your payments each month Reduce Term (Months) Calculate how much extra you need to pay each month in order to pay off your loan early Current Loan Balance the original amount on a new loan or principal outstanding if you are calculating a current loan Interest Rate the annual interest rate (stated rate) on the loan Remaining Term (Months) number of months which coincides with the number of payments to repay the loan. Create amortization schedules for the new term and payments. Try different loan scenarios for affordability or payoff. Enter the cars MSRP, final negotiated price, down payment, sales tax, length of the lease, new car lending rate and the cars value after the lease ends. Subtract the 220,000 outstanding balance from the 410,000 value. 360 months.Use this calculator to determine 1) how extra payments can change the term of your loan or 2) how much additional you must pay each month if you want to reduce your loan term by a certain amount of time in months. Assume your home’s current value is 410,000, and you have a 220,000 balance remaining on your mortgage.

#AMORTIZATION CALCULATOR FULL#

1Īmortization extra payment example: Paying an extra $100 a month on a $225,000 fixed-rate loan with a 30-year term at an interest rate of 3.875% and a down payment of 20% could save you $25,153 in interest over the full term of the loan and you could pay off your loan in 296 months vs. Use this amortization calculator to help you determine how many months it could take to pay off your loan with or without making extra payments.Ĭonforming fixed-rate estimated monthly payment and APR example: A $225,000 loan amount with a 30-year term at an interest rate of 3.875% with a down payment of 20% would result in an estimated principal and interest monthly payment of $1,058.04 over the full term of the loan with an Annual Percentage Rate (APR) of 3.946%. What is the effect of paying extra principal on your mortgage?ĭepending on your financial situation, paying extra principal on your mortgage can be a great option to reduce interest expense and pay off the loan more quickly. It also shows total interest over the term of your loan.

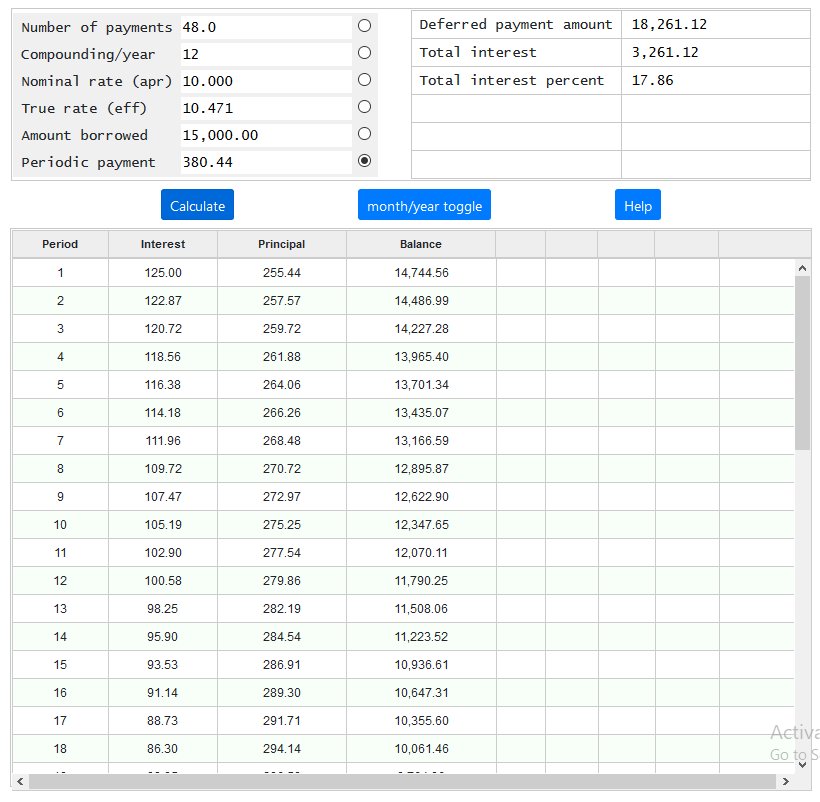

An amortization schedule shows how much money you pay in principal and interest. But, over time, more of your payment goes towards the principal balance, while the monthly cost or payment of interest decreases. With a fixed-rate loan, your monthly principal and interest payment stays consistent, or the same amount, over the term of the loan. Find a financial advisor or wealth specialistĪmortization is the process of gradually repaying your loan by making regular monthly payments of principal and interest.

0 kommentar(er)

0 kommentar(er)